India’s benchmark index Nifty 50 has witnessed a sharp recovery, gaining nearly 10% from its April low, touching 24,461 on Monday. The index hit its lowest point of the current financial year at 22,161.6 on April 7, 2025, marking a significant rebound in just over a month.

Despite short-term volatility, Nifty’s longer-term returns present a mixed picture:

- 3-month gain: 2.55%

- 6-month gain: 1.46%

- 1-year return: 8.32%

However, the index made its 52-week high of 26,277, recorded on September 27, 2024.

Mutual Fund Categories: Top Performers Since April 7

Following equity mutual fund categories have shown strong performance:

| Category | Average Return (%) |

| Auto Sector Funds | 11.17% |

| International Funds | 10.52% |

| Technology Funds | 10.44% |

| Mid & Large Cap Funds | 8.94% |

| Pharma Funds | 6.92% (lowest) |

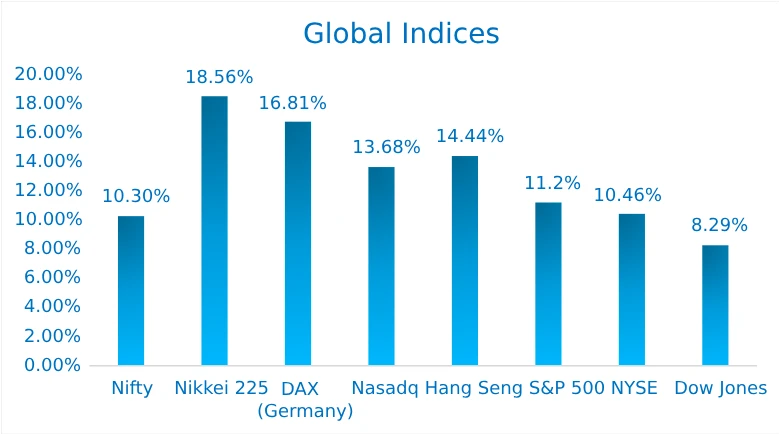

Global Markets Mirror the Rally

The recovery is not limited to domestic markets. Global indices have also posted impressive gains, reflecting improved investor sentiment and macroeconomic stability:

| Index | Return Since April Low (%) |

| Nifty 50 | 10.30% |

| Nikkei 225 | 18.28% |

| DAX (Germany) | 16.66% |

| Nasdaq | 15.21% |

| Hang Seng | 13.49% |

| S&P 500 | 12.33% |

| NYSE | 11.61% |

| Dow Jones | 8.82% |

Recommendation:

- In this volatile scenario, follow asset allocation as per your financial goals.

- Increase your monthly investments in equity through Systematic Investment Plans (SIPs) and continue with your existing SIPs.

- Review your health and term insurance coverages.

- Ensure your assets, including home/office, against risks.

- Consult Abhishek Bansal or your Financial Advisor on a regular basis for guidance on When to invest, How to invest, and Where to invest.