The PMS industry, now worth ₹32 lakh crore, is growing fast as Investor’s seek better returns With India’s economy booming, PMS managers can capture outsized gains.

Enter PMS (Portfolio Management Services):

With Minimum Ticket size of 50 Lakh INR, PMS offers tailored portfolios and high-conviction, growth oriented picks.

What PMS offers ?

- Customised Portfolio

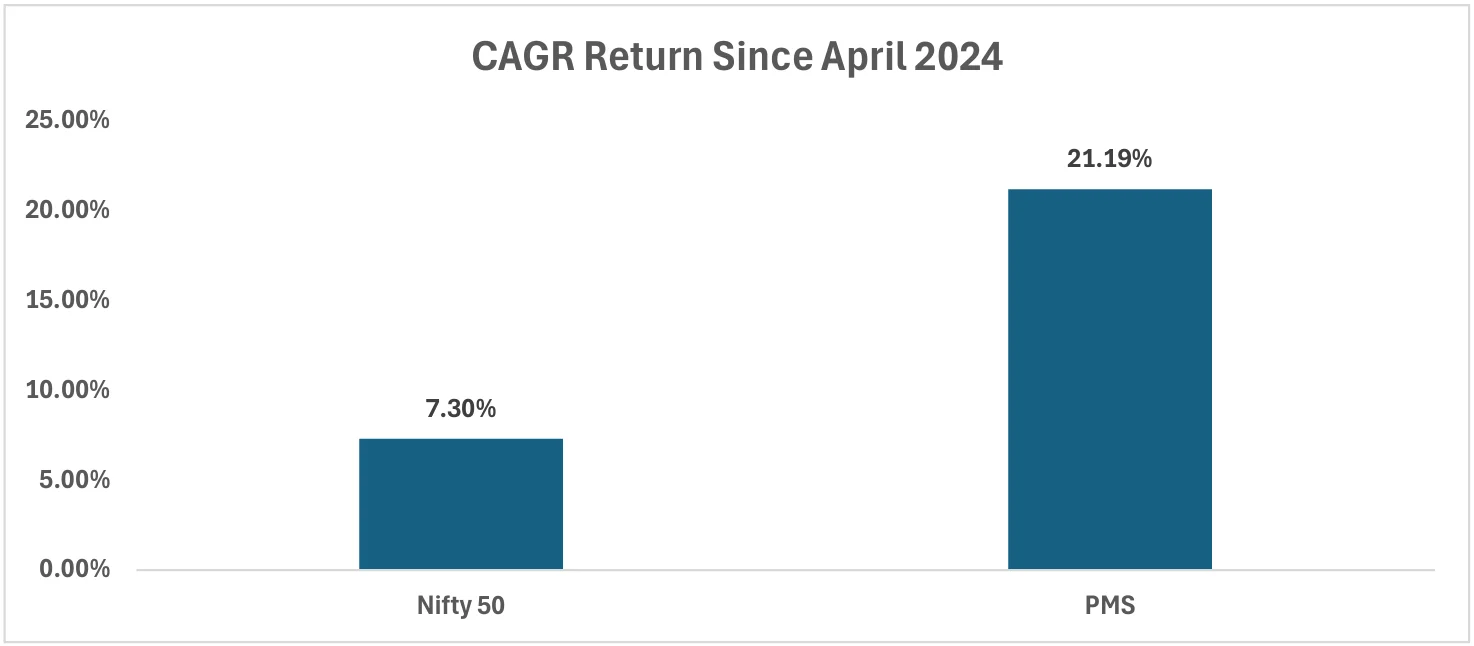

- Potential for Higher Returns

- Focus on themes where structural transformation is underway.

- Adapt themes while preserving the overarching philosophy for sustained impact.

- Targeting deep opportunities in 3 or 4 key sectors simultaneously.

- Focus on high-quality companies

- Capitalising on undue pessimism

PMS vs Mutual Funds

- The portfolio manager offers more personalized handholding than what the client has experienced with personal management, brokers, or mutual funds.

- One can also expect to interact with the portfolio manager to discuss any concerns that he might have, though not frequently.

- All administrative matters, including operating a bank account and dealing with settlement and depository transactions, will be handled by the Portfolio Manager.